Is Southwest Stock Undervalued – Weekly Investments’ Weekly Pick

Featured Image from © Tomasz Zajda @ stock.adobe - Is Southwest Stock Undervalued

Is Southwest Stock Undervalued – Intro

Our stock pick of the week this week goes to Southwest Airlines (LUV). To explain a bit on how we choose our weekly picks is we believe the very first question an investor should ask himself/herself when picking a stock is, “Is this stock undervalued?” It is never “will Southwest stock increase in price”. In turn an investor should ask, “Is Southwest stock undervalued?” This stock has recently been beaten down by increasing expenses (fuel and labor prices) along with the unfortunate event which ended with one passenger losing her life upon flight 1380. At $52.25, Southwest Airlines (LUV) is an awesome buy and hold stock.

Southwest Airlines (LUV) released first quarter earnings today which increased by 23% to 75 cents in comparison to Q1 2017. This beat the forecasted consensus of $0.74. Revenue additionally rose 2% to $4.94 billion but missed estimates of $5.018 billion by approximately $78 million. This lack of revenue can largely be attributed to the late 2018 spring break schedule. Although revenue has decreased, Southwest has still displayed its determination to continually become more efficient. Also, the new tax law didn’t hurt matters by saving Southwest roughly $54 million dollars.

These metrics have all been overshadowed by the unfortunate event that transpired on April 17th in which a passenger Jennifer Riordan lost her life. Southwest came out this morning and said it expects a 1-3% decrease in revenue per mile in the April-June quarter. 1-2% of this decline is due to a decrease in sales since the event. Although there will likely be a temporary decline in sales, I do believe that this crisis exhibited that Southwest Airlines’ customer service and crisis management is second to none in the industry. Southwest came out right away and addressed the issue, apologized, took ownership, and announced what would be done both currently and in the future to prevent such an event from reoccurring. The crew members handled it well given the circumstances which exhibits the training and how much Southwest Airlines invests in its people.

Quantitative Reasonings – Is Southwest Stock Undervalued

PEG Ratio

In accordance with Finviz, LUV has a PEG ratio of 0.79. This assumes a five year growth rate 19.77%. This is an exceptional PEG ratio and hints at LUV being an undervalued stock.

WAAC vs ROIC

Return on Invested Capital (ROIC) vs. Weighted Average Cost of Capital is a excellent way to measure management effectiveness. ROIC is essentially the return a company gets from the capital it has invested. WACC is the estimation of cost of capital when taking into consideration debt and equity on a weighted average basis. If ROIC is greater than WACC it means that for every dollar invested the business makes more than it cost to initially invest it in the form of capital. Conversely, if the WACC is greater than ROIC then it costs more to put money in as capital than the company is getting out. Gurufocus has ROIC at 41.69% and WACC at 9.42% for Southwest utilizing December 2017 data. To interpret this, this means the average cost of capital invested for LUV is 6.6%. The return on this capital is 41.69%. Needless to say if I was loaned money for an average interest rate of 6.6% and in return received a ROI of 41.69% I would conclude this to be a great investment.

Intrinsic Value and Margin of Safety

This is my personal calculation based upon Benjamin Graham’s formula but I have altered it a bit to be more conservative. So Intrinsic Value =(EPS*(7+1*G)*4.4)/4

Data Below is from Finviz.com:

Facebook EPS= 3.45

Growth 5 year avg.= 19.77%

So (3.45*(7+1*19.77)*4.4)/4 = Intrinsic Value

Intrinsic Value $101.59

Less: Current Price $ 52.25

Margin of Safety $ 49.43

Margin of Safety % 48.56 %

As a value investor, I look for at least a 25% margin of safety.

Other Ratios – In Accordance with Finviz

Financial Strength

Quick Ratio 0.6

Debt-to-Equity 0.36

LT Debt-to-Equity 0.33

These are excellent ratios which indicate that Southwest is not over leveraged and is well positioned to overcome future unknowns.

Profitability

ROA 14.4%

ROE 38.8%

ROI 16.5%

Profit Margin 16.5%

These are solid indicators which display that Southwest Airlines is operating efficiently and profitably.

Qualitative and Intangibles – Is Southwest Stock Undervalued

Southwest ranks amongst the top three of all major US airlines for almost every operating and financial category. Refer to SeekingAlpha for a good article on the large US Airlines’ rankings. Southwest by far operates the most effeciently along with having the best balance sheet.

Brand Recognition – Southwest has a trusted no hassle brand image. They distinguish themselves from the pack with excellent customer service along with their innovative processes (i.e. seat yourself).

Customer Loyalty – Southwest Airlines has excellent customer loyalty. Their low price, free bag check, and excellent customer service makes it easy for frequent fliers to choose them time and time again.

Negatives – Is Southwest Stock Undervalued

Some analysts are worried whether low cost carriers in the US airline industry actually have a sustainable business model. I myself am not worried. First, since its infancy, Southwest has continued to become more efficient and profitable. Second, as Southwest grows, so does its economy of scale which will make it much harder for the smaller airlines to compete on price. Lastly, from the looks of it, none of the big US airlines want to even try to compete on price. It appears Delta, United, and American Airlines have instead proceeded to make their Fleets more luxurious which in turn can fetch a larger price tag.

Conclusion – Is Southwest Stock Undervalued

It is my personal belief Southwest is undervalued at $52.25 and a great stock to buy and hold. It is relatively cheap with strong financials. Management has displayed they are able to handle and adapt to a serious crisis. Additionally, Southwest’s customer service is amongst the top in the industry and their employees are satisfied and well trained. It is for these very reasons when we ask the question “Is Southwest Stock Undervalued?” this becomes Weekly Investments LLC’s pick of the week.

Analyzing of Prior Stock Picks – How Are They Doing

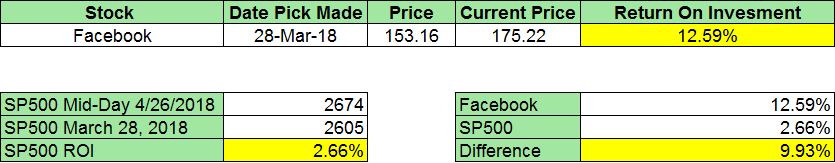

Wondering what would have happened if you had bought our picks in the past? On March 28th, Weekly Investments LLC made its very first stock pick in the following article and Facebook was chosen. The chart above displays how much you would have made if you chose to invest in Facebook on that date. Facebook as of the writing was trading at $153.16 compared to now, less than a month later trading at $175.22. This is a 12.59% ROI in less than a month. Compare that to the SP500 ROI during the same period calculated above to be 2.66% and that is a 9.93% difference!!! This is greater than the average annual return of the SP500 over the last 90 years. Stay tuned for more Weekly Investments LLC picks to come.

To learn more about Weekly Investments’ picks visit our blog.

DISCLOSURE: At the time of this writing, Weekly Investments LLC. and/or the contributor(s) of the content have known positions and/or business relations in Southwest Airlines.

This article was written expressing personal opinions and in no way, in part or in whole, does Weekly Investments LLC., its contributors, or any of their affiliates guarantee the validity and/or accuracy of the content above.

Additionally, neither Weekly Investments nor its contributors are financial advisors and this should not be taken as professional advice or instruction. It is the readers sole duty to verify information stated within and personal and/or financial decisions should not be made based upon any information gained.