Danaos Stock Price is Undervalued: 15 Reasons Why DAC Stock Price is Undervalued

Background Danaos:

Danaos (DAC ticker) is one of the largest owners of containerships. Danaos is a Greek company which charters its containerships at fixed rates to liner companies. We first began recommending Danaos in September 2020 when the company was seriously beaten up at roughly $4.60 a share. The belief was it was significantly undervalued based upon the market not recognizing management effectiveness/efficiency, a shortage of containership supply to meet market demand, significant delays due to COVID causing supply chain bottlenecks and congestion at ports, the large COVID related e-commerce boom, companies restocking depleted inventories, and significant undervalued assets on its books which were not being fully accounted for; which included, approximately 10 million shares (10%) of ZIM Integrated Shipping Services which had yet to go public; therefore, it was being held on Danaos’ books for roughly $75k. As of the time of this writing 10 million shares of ZIM would be worth approximately $400 million. To compare, the average market cap of Danaos DAC stock in September 2020 was about $150 million. Danaos first stood out when researching the containership market by how well the management has been both in efficiency and effectiveness in comparison to competitors. It came at even more of a surprise when I found out this company that is operating with better margins was trading at a significant discount compared to peers. This was largely due to a significant amount of debt held by the company and questions around the solvency of the company. As stated in Rich Dad Poor Dad, there is good debt and bad debt. When a company can use debt (within reason) to invest in fixed assets which retain value and increase earnings above that of other income producing alternatives, I considered this good debt. The issue was largely that this debt appeared significantly dangerous to the untrained eye. Do not get me wrong, if rates would have remained oppressed and global trade would have completely frozen due to COVID, all shipping companies, including Danaos, would have been in serious trouble; but by September 2020, most of the economy had opened up again and with a little bit of research one could recognize the supply chain issues based on port congestion and the great toilet paper shortage of 2020 (haha jk can’t mention 2020 without mentioning this). Many investors were not considering the current market, demand increases due to work-from-home, supply shortages due to port congestion and closures, the rising prices of steel, and the low interest rates which Danaos was working towards utilizing by restructuring its debt. In addition to the effective management and undervalued assets, I found this industry attractive due to being significantly beaten up for the last decade, its simplistic nature, and the ability to predict income somewhat accurately for chartered ships. However, chartering containerships is a cyclical industry which can be impacted by a multitude of variables such as government regulations and global demand. So is DAC stock price still undervalued?

I can go on and on about why I recommended this stock and how it has increased well over 1000%+ since first recommending/investing in September 2020 but hindsight is 20/20 (no pun intended). The real reason for mentioning the above reasoning is that many of these rationales which initially stood out, have not changed (aside from price which will have to be revisited to assure the investor he/she still maintains a healthy margin of safety); if anything, the absolute best case scenario for both the business and industry has occurred since our initial investment/recommendation.

Current Day DAC Stock Price and DAC Stock Forecast:

As of the start of this writing, Danaos has dropped to under $60 from it’s high of over $78 a few weeks ago. It is my personal belief this market has created an opportunity for the informed investor. I remain perplexed how investors aren’t recognizing the significant upside and positive future of this company; but I am glad they aren’t, I love me some cheap undervalued stocks. The following are 15 reasons I believe DAC stock price is undervalued:

#1) Record Charter Rates

Charter rates are hitting new records practically every week with 3-4 year charters becoming the norm (terms in previous years were much shorter usually 6-12 months and rates were significantly lower). Greater risk accompanies shorter charter lengths, especially for carriers; therefore, as charter contracts have begun being coupled with longer timeframes, I believe it leaves Danaos with less exposure to market fluctuations in addition to providing the ability for both investors and management to more accurately calculate estimates. Although most charters are being contracted for longer periods, some shipowners are exploiting the benefits and flexibilities of short-term charters. The following article by Freightwaves discusses how multiple shipowners have already been able to charge $100k+ a day for short-term charters. This rapid acceleration in charter rates coupled with long-term contracts has caused DAC stock price to return well over 1000%+ over the past 12 months.

The HARPEX index tracks containership rates for containerships. The graph below from the HARPEX website displays the past one-year change.

Per LloydsList, “Rates are up between 10.7% and 5.5% week on week, and between 45% and 17.4% higher on the month-ago period, and as much as seven times the going rate 12 months ago, according to VHBS.”

Yep, you read that right, as much as SEVEN times the going rate of 12 months ago.

#2) Danaos ownership of ZIM stock.

Danaos still owns a significant amount of ZIM stock (over 8 million shares from personal calculations after the previous consolidation): ZIM currently trades at roughly $38. ZIM is paying a $2 dividend in August 2021 and has said that it has plans to by 30-50% of 2021 net income in 2022. The 2021 EPS estimate for ZIM according to MarketWatch is $18.17. If Danaos still owns roughly 8 million+ shares, Danaos will receive $16 million in dividends in August 2021 and using the average of 40% earnings (40% x EPS $18.17) = $7.27. In dividends alone from ZIM within the next year and a half, Danaos will be receive approximately $74 million ($9.27 * 8 million shares). Please note this isn’t taking into consideration selling any shares.

#3) Danaos dividend reimplementation

Danaos reimplemented a $2 annual dividend which at the current DAC stock price of roughly $60, dividend yield is greater than 3%. Some may complain this dividend is not enough but take into consideration the average SP500 stock dividend as of June 2021 according to YCharts is roughly 1.35%. In addition, when a company is employing capital and attaining great margins of profitability, why would one want to pay additional taxes on dividends? Per Finviz.com, Danaos has a ROE of greater than 38%. Would the average investor be able to produce this return after paying taxes? Even if no taxes were to be paid, would the investor be able to make this return? If you honestly believe so, please reach out to me with such an investment, as myself and our readers would be most interested.

#4) Solid/Consistent Management

Management is making solid decisions, staying focused, finding solid acquisition targets and paying cash for such acquisitions (note: the biggest risk in the past for Danaos was being heavily leveraged so yes financing such acquisitions would likely bring with it a greater rate of return but I personally believe it’s nice to see management prioritizing solvency over returns). I believe management’s decisions on their recent acquisitions were solid given the current market environment (refer to my evaluation of the most recent transaction below). Most, if not all, of these ships from recent acquisitions already have charters attached with contracts expiring and being rechartered at likely much higher rates prior to 2023. Note: The relevance of 2023, is it is the soonest any significant amount of newbuilds will set sail.

For additional information regarding Danaos’s recent acquisitions, here is a great article on Seeking Alpha.

Evaluating Danaos’s most recent acquisition:

From the press release on Danaos’s webstie, this is what we know:

“Danaos Corporation (the “Company”) (NYSE: DAC) today announced that it has entered into an agreement to acquire six 5,466 TEU container vessels built at Hanjin Subic Bay shipyard en bloc for $260 million (the “Acquisition”). The vessels, which have an average age of 6.8 years, are on time charter contracts to leading liner companies with a weighted average charter duration of approximately 2 years.

The Acquisition will increase the Company’s contracted revenue by approximately $71 million and the Company’s contracted EBITDA by approximately $39 million in total and will be funded by cash at hand, although the Company is evaluating debt financing alternatives to finance part of the purchase price.”

Facts:

Number of Ships: 6

Size of Ships: 5,466 TEU

Avg. Age: 6.8 Years

Total Cost: $260 million

Payment/Financed: Cash

Avg. Charter Duration: 2 years

Additional Contracted Revenue: $71 million

Additional Contracted EBITDA: $39 million

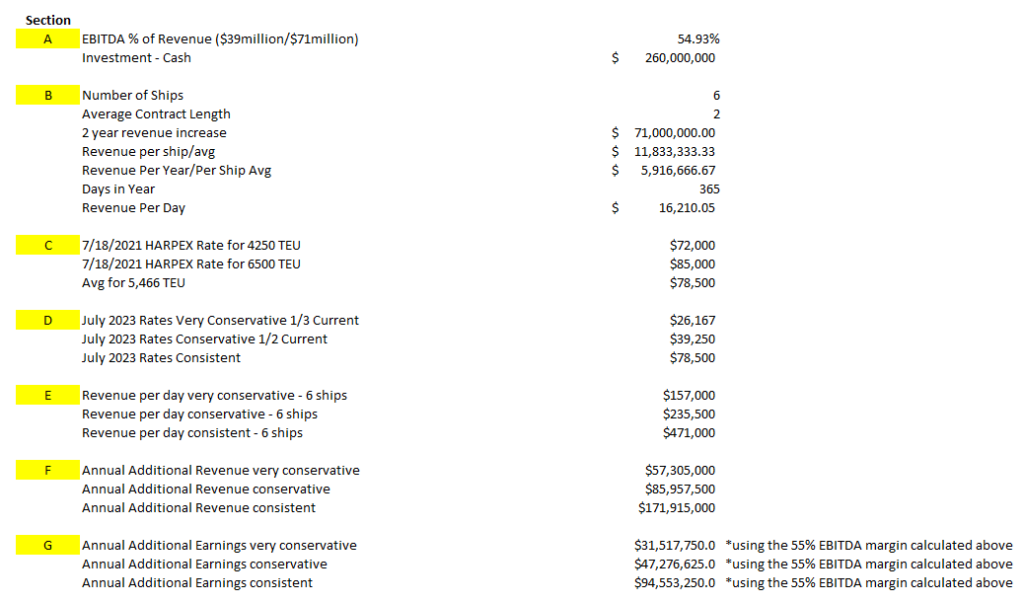

Below are screenshots of my analysis of the transaction, please verify my numbers and recognize I use what I believed to be conservative estimates to maintain a good margin of safety:

Figure #1:

Figure #1 breaks down the information provided in the Danaos press release. From the calculations in Section B, it appears the average current charter contract per ship is roughly $16,210 per/day. This means these contracts were likely entered into last year near the bottom of the market. Section C utilizes information from HARPEX which from our calculations put the present-day average for containerships of similar size around $78,500 per/day. $78,500 vs $16,210, yep you heard that right. Since we are currently at record high rates, Section D’s calculations are conservatively adjusted to calculate what these rates may be in 2023 (average timeframe when these ships will become available to be rechartered). For instance, line 1 of Section D calculates future rates at one-third of current rates. I believe this is quite conservative and builds in a significant margin of safety. At this conservative rate the average ship will be rechartered at $26,167 per/day which for 6 ships equals roughly $157,000 per/day of revenue (Section E) and about $57,305,000 annual revenue. Utilizing the EBITDA % calculated in Section A of roughly 55%, this would equate to earnings of $31,517,750 per annum.

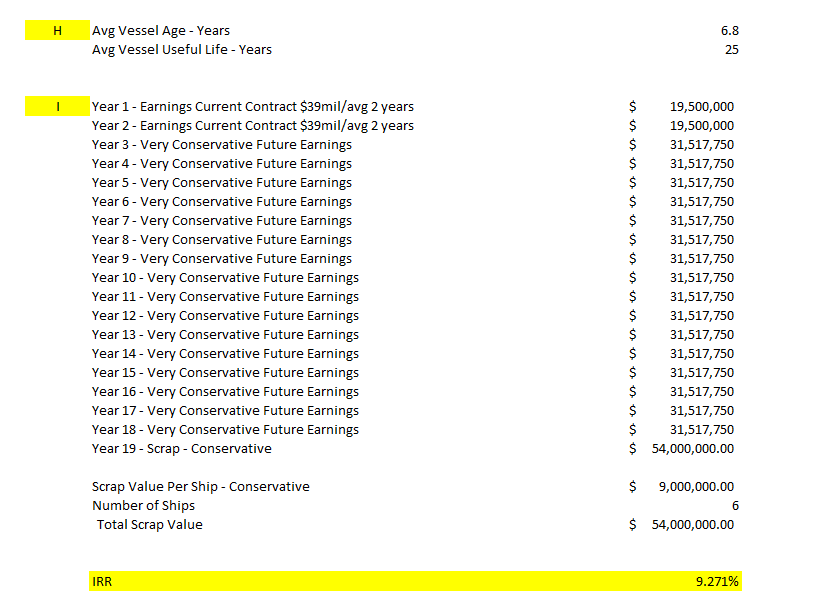

Figure #2

Figure #2 uses the information provided from the Danaos press release which lists the average vessel age of 6.8 years. It also assumes a scrap value of $9 million per ship after a total of a ship useful life of 25 years. When analyzing any investment decision one of the first evaluations I consider is Internal Rate of Return on future cashflows. Since these are what I consider to be conservative estimates with a margin of safety already built in, the minimum rate I am searching for is an internal rate of return greater than a risk-free rate of return which I will use the rate of a corporate AAA bond (for this example, we will seek anything north of 4%). Please note Year 1 and Year 2 are already contracted earnings per the Danaos press release: $39 million earnings with an average charter of 2 years ($19.5 million per year). Year 3-18 use the most conservative calculations from Figure #1. After considering annual earnings, scrap value, and the $260 million cash investment, the IRR is 9.271%. I am please with this IRR, not necessary as a % but as this is the most conservative of our estimates with significant upside potential alongside the company’s ability to refinance these ships later to most certainly substantially increase IRR.

#5) Healthy Global Trade

COVID kicked off a rapid rise in demand for global trade. DAC’s stock price has increase rapidly since then along with DAC’s stock forecast.

According to UNCTAD’s Global Trade Update, the recovery of world trade from the COVID-19 crisis hit records in the first quarter of 2021, increasing by 10% year-over-year and 4% quarter-over-quarter.

Here is great article which references the current condition of global trade.

#6) Marine shipping has been excluded from the global minimum tax conversation.

The global minimum corporate tax was of concerning the containership industry earlier this year as most carriers do not pay corporate tax due to the counties they are incorporated out of. A final agreement is far from finalized but earlier this month it became clear the marine shipping industry will likely be exempt from a global minimum tax.

Although this worried many investors, I personally did/do not see this as big of a deal as some investors especially for companies which charter these ships; after taking into consideration depreciation and other shipping related costs/fees which would need to be considered if global minimum tax began to apply to these companies, I do not believe it would have as significant impact as many were suspecting.

This article by Lloyds list discusses this further.

#7) Management has remained cautious and conservative

Management appears to have learned from past market volatility/fluctuations and has not over leveraged or placed large orders for newbuilds in an expensive environment. All management looks great when things are going well but it’s when things are going bad when investors find out who they truly have put in the driving seat; for the past decade things have been going quite bad for this industry and management has remains transparent and consistent. What concerns me is when a management becomes heavily influenced by short-term investors as this can be quite troublesome for the long-term shareholder. I believe Danaos management is focused exclusively on this business and its long-term shareholders. This stock took a hit initially after the Q1 2021 earnings call as the company said it was building a war chest for unpredictable times and future investments. These short-term fair-weather stockholders were upset as they were at first pushing to reinstate a dividend, then that occurred, then they began pushing to raise dividends and/or receive a ‘special dividend’ like that which ZIM Integrated Shipping is paying out. Even after this pressure and the stock taking a short-term hit, management remained unphased and focused on their business plan. This is very much appreciated and displays a management which is directly aligned with long-term company growth and not inflating the stock price for personal gain.

#8) The containership resale market including scrapping/steel prices are at extremely high rates.

According to an article by Fortune.com dated July 8, 2021, steel prices have risen 215% since March 2020.

#9) Danaos Q2 Net Asset Value (NAV) Likely to Be Greater than $100 per share

According to the Danaos Q1 2021 presentation, the Net Asset Value per share was $90.90. With rising steel prices https://www.wsj.com/articles/ship-orders-surge-as-carriers-rush-to-add-capacity-11623179052, additional cash, new acquisitions, and contracted revenues, I believe the NAV for Q2 will easily come in north of $100 per share. To be able to purchase a stock with a NAV of $100 for DAC’s stock price of roughly $60 with a strong management and strong fundamentals I believe is quite a bargain; therefore, I believe DAC stock price is quite undervalued. Buy your stocks like you buy your groceries, not your perfume.

#10) Danaos Focused on Its Niche: 2,000 TEU-10,000 TEU Containerships

Danaos is clearly focusing on a segment of the containership market that has been ignored and new ships in this category have hardly seen any newbuilds over the past decade: 2,000 TEU-10,000 TEU containerships. This size of ship can be accompanied with some serious benefits the market appears to be mostly ignoring, such as, accessibility to smaller ports, maneuverability, flexibility, easier to load and unload, and future regulatory uncertainties which might make these ships highly sought after. I would also argue this diversifies risk for carriers and liners. With the new 20k+ TEU Megamax ships, if one thing goes wrong such as the Ever Given and the Suez Canal situation, there can be serious consequences. Yes, one may argue that the chartering company is not liable for many of these potential issues, but when significant damages occur, the fingers tend to point in all directions. By specializing in this size, if issues arise with one ship, consequences are not near as severe in in comparison to a MegaMax ship. I also believe the industry may finally be somewhat beginning to recognize the usefulness of these ships referencing Loyd’s List which mentions 47 second-hand vessels were sold in June 2021 and of that amount 29 were in the feedermax category (of 2,000 to 3,000 teu).

Per Lloyd List’s Article, “They are also commending rates at about $75,000 per day, based on fixtures reported by brokers.

The 2007-built, 2,741 teu Posen (IMO: 9349887) was chartered for 12 months for $75,000 daily while Interasia Lines took the smaller and younger Hansa Colombo (IMO: 9357781) for three years at a daily rate of $28,000.”

#11) Fairly Predictable Estimates

Since revenues are based on fixed charters, cash flows can at times be fairly easy to predict in comparison to other industries. The only significant risk to these contracted revenues is if the liners chartering Danaos containerships stop paying or go bankrupt; but I believe this risk is minimal as these companies which Danaos charters to are currently producing record revenues due to record high rates; since most new charters are on 3-4 year terms, I find it to be difficult for these currently high cash producing liners to go bankrupt within this timeframe.

As of the beginning of Q2 2021, my calculations had roughly ⅓ of Danaos being rechartered within the next year. This is huge. Many of those charters were at MUCH lower rates on shorter term contracts. These new charters should command significantly higher rates with 3-4 year terms. With the COVID outbreak in China causing more supply chain disruptions going into the peak season, I do not see rates substantially easing until at least Q1 2022 at the earliest.

#12) Government Involvement/Regulation

Some governments are looking into the transportation industry but on multiple occasions it has been stated there isn’t much they can do about shipping as it is the basic economics of supply and demand. I personally believe governments are much more likely to focus on infrastructure such as expanding ports and on port congestion as this is more within their control.

#13) IMO 2020 Potentially Slowing Speeds Down – Decreasing Supply

IMO 2020 has the possibility of slowing down ship speeds to meet carbon regulations. I first read about this a few months ago. I was a bit surprised it was the first time I heard about this, and this had not dawned on me earlier. To me, slowing down ship speeds is the same thing as decreasing the market supply of ships. Less trips equals less supply. I believe this is one of the most unaccounted for yet potentially significantly impactful constraints on the industry which could keep rates at high levels. If ships are forced to slow down, going off past orderbook data to balance supply and demand would be like comparing apples to oranges.

For an example, let’s say you are moving 40 boxes and have an option to rent a pickup truck which carries 20 boxes and only takes 10 minutes to get to the destination or you can rent 2 pickup trucks which fit 20 boxes each, but they take an hour to get to destination. Obviously, the single pickup truck would be more efficient even though the supply in the latter scenario of 2 trucks appears greater. But is the supply in the scenario of 2 trucks actually greater? Depends on what you are measuring. In both containerships and this example, we have a certain amount of supply needing to be moved but by slowing down the speed at which it moves, this also decreases the amount of supply moved within a specified timeframe. In both cases, the business is transporting fixed amounts of cargo, so the number of boxes moved within a given time period is of much more relevance and impactful on a supply shortage than the number of boxes carried or number of vessels/trucks used to carry them.

Why is this relevant? Because container shipping is a cyclical industry which is controlled by rates. Basic economics tells us there are two main ways to increase price: either increase demand or decrease supply. Slowing down ship speeds could certainly decrease the supply of ships available to move cargo; therefore, increasing rates.

An interesting June 2021 article examining the carbon restrictions and potential of slowing down ship speeds from is linked below

#14) Insider ownership

Danaos shipping has been a family ran business operating ships since 1972. According to Finviz.com, insider ownership is greater than 50%. This coupled with the fact insiders have not been selling even after the significant rise in price over the past year, tells me they still believe there is value in this stock and at the very least, it is fairly priced.

#15). Port Congestion and Delta Variant

Research shows port congestion persists causing continual delays going into peak season. There are several articles which can explain this further and do a much better job of explaining than I. Scares from the new COVID Delta Variant may only exhaust an already highly strained supply chain further into the near future.

Considerations and Uncertainties:

Debt

Danaos just recently restructured its debt but still carries a decent amount of it. In comparison to past ratios though, it is quite low, and this company has fixed assets to secure this debt. Additionally, the significant majority of this debt is used to buy income producing assets (containerships).

IMO 2020

This will play a major role in the industry moving forward leaving some uncertainty. As stated in #13 above it may not be all negative though.

Large Orderbook

The current orderbook is roughly almost 20% as of the end of Q2 2021. According to Global Marinetime Hub, the container ship orderbook has more than doubled from a year ago of 9.4%. Even with this being so, the past few years have been near record lows in regard to the active orderbook and it will take 2-3 years to build any ships ordered; therefore, there isn’t going to be any relief prior to 2023 with regards to the containership supply.

Cyclical Industry

I believe with new contracts terms averaging 3-4 years, liners and shipowners both experiencing significant positive change in their financial positions, and companies learning from the horrific past decade, rates will not return to previous lows for quite some time, if ever.

Conclusion – DAC Stock Price and DAC stock forecast:

Based on current charters, my estimated calculation of future charters, recent acquisitions, ZIM dividends/settlement of notes, etc. I conclude 2 things regarding DAC stock forecast and DAC stock price:

#1 NAV for Q2 2021 will be excess of $100 per share.

#2 My target price for DAC stock price now sits at $96.

This could be a great opportunity for the informed investor to invest prior to the market further recognizing that DAC stock price is undervalued.

DISCLOSURE: I myself and/or affiliates are invested in Danaos DAC stock and/or its affiliates. This article is based on personal interpretations, calculations, and opinions. The validity/accuracy of any information within is not guaranteed. It is the reader’s/user’s sole responsibility to verify/confirm any information from Weekly Investments LLC and/or its affiliates. Although many of these points are supported by 3rd party sources, Weekly Investments LLC does not guarantee the accuracy or validity of any 3rd party sources and/or affiliates. Weekly Investments and/or affiliates are not investment or tax or legal professionals. Any information should not be taken as investment, tax, or legal advice.