How to Get Rich: Compounded Growth

Featured Image Above from © Karen Roach @ stock.adobe.com

Compound Interest Leads To Compounded Growth:

There are three inputs into the calculation of invested wealth: Annual return, time, and the principal investment. The average investor cannot expect abnormal returns nor can he expect the ability to make a large initial investment. What the average investor can expect and potentially control is the length of time his investment is in the market. The longer an investment is in the market, the greater the rate in which the investment grows due to compounded growth.

Albert Einstein said, “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t….pays it”

For the majority of individuals, compound interest will be the main reason why they will be able to retire. Let us use an example of two individuals: the conservative individual and the enlightened investor. Both individuals work from ages 25 to 65 making an average salary of $50,000 and save 10% of their money throughout this time. The conservative individual hides his 10% savings under his bed while the enlightened investor puts his investment in a well-managed 401k account which accrues interest compounded at a tax-free rate of 10%. By the age of 65, the conservative individual would have saved only $200,000 ($5,000 x 40 years); meanwhile, the enlightened investor would have amassed a small fortune in the amount of $2.4 million.

Understanding Compounded Growth & Compound Interest:

This is not a get rich quick scheme nor am I trying to sell you anything including false hope. Over the long run, your principal investment is not what will make you rich, rather your interest on that initial investment making interest on itself will.

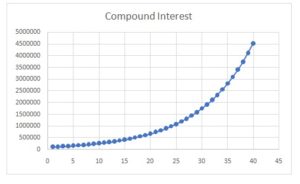

Let us say an investor were to invest $100,000 today which earns a 10% interest per annum. After the first year, this investor would have $110,000, which would be made up of $100,000 of original investment and $10,000 of interest from year 1. That very next year that $10,000 of interest from year one would earn interest on itself in the amount of $1,000. This is how real wealth is built. Without another dollar ever being surrender to this investment, after forty years this investment would have amounted to roughly $4.5 million.

The diagram below gives a visual explanation of the compounded growth concept. The greater the amount of time in the market, the faster the line (the investment) rises. Feel free to utilize some of our free easy-to-use calculators to assist in making such calculations.

Compounded Growth Graph

The last example I will provide is a choice between giving you $100,000 cash today or giving you a penny that would double in amount for 30 days. If you chose the penny, then you would be much happier upon retirement. That individual would receive approximately $10.7 million due to compounded growth.

Why to Invest Using Compounded Growth:

Most people respond to investing with the justification that why would they wait 40 years. I would argue under normal circumstances, that the minimal 10% that should be invested would not make any present person or family any happier. Is a worker that receives $55,000 10% happier than his co-worker that receives $50,000? If so then is a worker that receives $100,000 twice as happy as the worker that receives $50,000?

Happiness and fulfillment cannot be judged by use of any quantitative factors but rather qualitative interpretation. I will tell you however that when this worker that makes $55,000 and invested $5,000 per year instead of spending it, is able to put his grandchildren through college, has the ability to provide his wife with the best at home care until her last breath, along with the ability to donate to causes he cares so deeply about, these things accompanied by much more will bring true joy and fulfillment.

The rest of this compounded growth topic will be deferred for a later discussion but I will say two things: First off, one day you will love somebody more than you ever thought would be possible and you will wish to give them the world. Money isn’t everything but it does largely ensure a fair shot at life which many individuals are not fortunate enough to receive. It also can be a form of insurance when the unexpected happens in which normal everyday insurance fails to cover.

Lastly, due to modern advances in medical technology the percentage of individuals living to at least age 60 is on a steady rise. At birth an individual has well over an 80% chance of making it to age 60. Don’t be the only one of your friends working at age 60 with no end in sight. Be the retired friend who pays for that conservative friend’s trip to accompany him around the world.

Please visit our blog to learn more about how to use compound growth to retire at a young age.