Gold Price Prediction: A Bullish Case for Gold in 2025

Introduction

For over 5,000 years—dating back to 2600 BCE in ancient Mesopotamia and Egypt—gold has been a trusted gauge of economic stability and geopolitical tension. Today’s mounting uncertainties are once again triggering alarm bells, strengthening the bullish case for gold to continue its ascent. Several factors including tariffs, sovereign credit downgrades, and historic central bank buying have driven gold prices recently to fresh highs. After spiking to over $3,400/oz in early 2025 following President Trump’s “Liberation Day”, gold prices have pulled back slightly but remain historically elevated around $3,300/oz as of late May 2025.

So what caused gold to hit $3,400 in early 2025? And more importantly, is gold a good investment right now?

This report lays out the bullish case for gold, detailing:

- Top reasons gold may surge in 2025

- Gold price drivers in 2025

- Macroeconomic factors driving gold

- Historical parallels

- Under-the-radar signals

- Physical supply-demand dynamics

- And where gold could be headed next.

Some analysts, including JP Morgan, forecast gold could top $4,000 per ounce by Q2 2026. If you’re seeking a data-driven gold market analysis for June 2025 and beyond, here are some key factors to consider as we navigate the remainder of this already eventful year.

1. U.S. Credit Rating Downgrades: A Systemic Shock

One of the most powerful macroeconomic drivers for gold this year is the concern over the United States’ mounting debt which has lead to yet another credit downgrade.

On May 16, 2025, Moody’s joined Fitch and S&P in downgrading U.S. sovereign debt; this is a rare trifecta which echoes concerns over America’s future fiscal path. To put it into perspective regarding credit downgrades in relation to gold prices: Following Fitch’ downgrade on August 1, 2023, gold prices surged more than 25% over the following year ($1,944 on 8/1/23 vs $2,446 on 8/1/24) as investors sought out safe-haven assets.

This year, the story continues. Over the past year:

- Investors and institutions alike have begun shifting into gold as a hedge against the dollar and Treasury weakness.

- Confidence in servicing U.S. debt has eroded amid projections of a 156% debt-to-GDP ratio by 2055 (source: pgpf.org).

- High interest costs are ballooning, further pressuring the budget and making gold’s zero default risk ever more appealing.

These downgrades serve as credibility shocks to what was once considered the world’s safest investment haven. In this context, gold as an inflation hedge in 2025 and a hedge against fiscal instability becomes increasingly relevant.

“Gold strengthened—highlighting the metal’s role as a crisis hedge during sovereign credit events.” – Analyst commentary, post-2011 S&P downgrade

In short, the once stable landscape of security and certainty is shifting. Many warning signals are flashing red and investors are increasingly seeking alternatives.

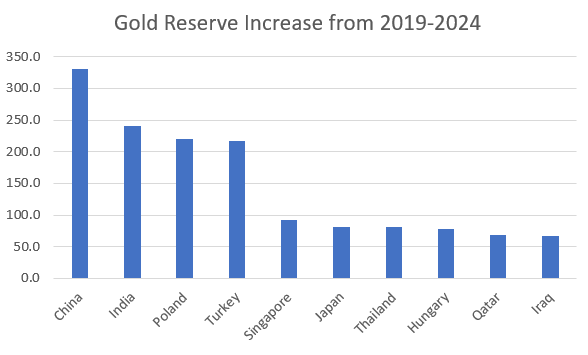

2. Central Banks Are Quietly Hoarding Gold — Especially in Asia

One of the most underappreciated forces behind gold’s rise is record-setting central bank gold accumulation, especially by emerging markets.

In 2024, global gold purchases hit 4,974 tons—the highest annual total in modern history. 2023 wasn’t far behind at 4,899 tons. These totals include over-the-counter transactions and signal growing distrust in fiat currencies.

The biggest buyers? China, Turkey, India, Poland, and several Middle Eastern countries.

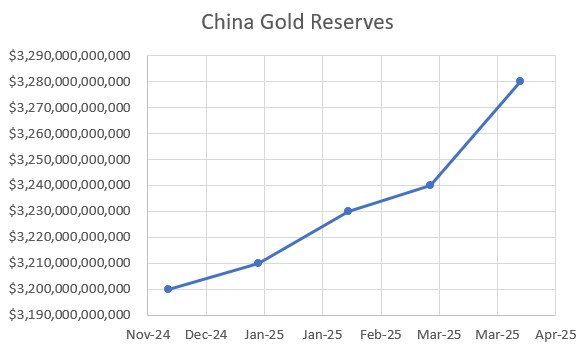

- China alone increased its reserves by $41 billion in April 2025, a 1.27% month-over-month jump.

- Its total foreign reserves now sit at $3.28 trillion, as of April 30, 2025.

What’s fueling this? Geopolitics. After Western sanctions froze Russia’s reserves in 2022, many countries began seeking out politically neutral assets.

This demand appears structural, not speculative. The macroeconomic factors driving gold now include a geopolitical pivot away from the U.S. dollar.

3. Physical Gold Delivery on COMEX Surges 700%

This may be an overlooked concept but it’s a critical gage.

The COMEX gold exchange, historically used for financial settlement of futures contracts, is now seeing a rapid increase in physical delivery notices.

- Half-way through May 2025, delivery requests were up roughly 700% compared to the entire month of May 2024.

- Between December 2024 and March 2025, 720 tons (25.4 million ounces) of physical gold were delivered into COMEX warehouses.

This isn’t small mom-and-pop buyers. These are large institutions demanding delivery of the real physical asset—not just paper gold. Why? Potential catalysts include:

- Concerns about counterparty risk

- Basel III regulatory changes affecting bullion banks

- Decreasing trust in “paper promises”

To make matters worse for physical supply:

- The Bank of England’s reserves are strained

- Four- to eight-week delays for spot gold deliveries are becoming the norm.

If physical gold availability continues tightening, a short squeeze in the bullion market may be on the horizon. When more contracts demand actual physical deliveries of gold, it strains the fractional-reserve system and that inherently leads to a spike in the price of gold.

This may be one of the strongest under-the-radar bullish case for gold arguments persisting in 2025.

4. U.S. Recession Risk and Market Disconnect

Despite short-term equity rallies, recession signals haven’t vanished. In fact, many believe the odds of a U.S. recession in 2025 remain fairly high.

- JP Morgan decreased its forecast of recession odds from 60% to “below 50%” after Trump paused select tariffs.

- But Jamie Dimon, CEO of JP Morgan, has warned multiple times that the U.S. economy is “not out of the woods.”

Much of the impact from the new administration’s policies has yet to show up in the data; less than two months have passed since President Trump’s ‘Liberation Day.’ The true impact of these historically bold policies will likely not begin to show up in the data for several months.

Key points:

- Equity markets are near all-time highs, with the S&P 500 recently topping 5,900.

- Yet macro indicators such as the historically high tariffs, deteriorating global relations, shrinking travel/tourism, small-business margin pressure, and delayed Fed cuts don’t appear to support such an increase in valuations.

Consider this: At the end of April 2 (prior to the tariff announcement), the S&P was 5,671. Despite more volatility, it’s risen to over 5,900 since then. Is that rational? Do you believe the economy is now in a stronger and/or more stable position than it was before April 2nd?

One such example, international travel is expected to plunge in 2025:

- According to the World Travel & Tourism Council, the U.S. is projected to lose $12.5 billion in international tourism revenue this year alone.

The ripple effect? Mid-size and small businesses who lack the bargaining power of the Amazons and Walmarts may suffer from the new administrations policies the most.

If a recession hits (and/or the Fed is forced into emergency easing), this will create a potential one-two punch for gold:

- Risk adverse flows into safe havens

- Lower interest rates, making non-yielding gold more attractive

Bottom line: The recession threat may not be fully priced in; and gold as an inflation/risk hedge would stand to benefit.

5. Trade Wars, Tariffs, and Global Uncertainty

If you’re wondering why gold may surge in 2025, geopolitical instability is a major catalyst.

The U.S.–China relationship continues to teeter between cooperation and confrontation; with the latter seeming to be prevailing. While some tariffs were recently paused, the broader trade war framework remains intact, with retaliatory threats continuously simmering beneath the surface.

We’ve seen this before:

- During the 2018–2019 U.S.–China trade war (which was far less extreme), gold rose more than 18% as tensions escalated.

In 2025, the stakes may be even higher. Why?

- The global economy is more fragile

- Allies are less aligned, as the current posture of the world’s largest economy has shifted to a “U.S. versus the rest of the world” approach.

- Daily social media posts have only accelerated diplomatic escalations

Beyond China, other flashpoints add fuel:

- The ongoing war in Ukraine

- Middle East conflicts

- Trade retaliation from the EU and allies over U.S. tariff policies

Actions such as travel bans or visa retaliation can ripple across markets. As we’ve seen throughout history, gold typically thrives in times of global disorder. And right now, there is no shortage of disorder.

6. The De-Dollarization Trend Accelerates

One of the most powerful but underreported themes of 2025 is the weakening dominance of the U.S. dollar and its direct implications for gold.

Here’s what’s happening:

- According to the IMF, the USD made up just 57.39% of global currency reserves by Q3 2024; the lowest share since 1994.

- That’s down from over 71% in 2001.

This slow erosion of confidence in the dollar has encouraged nations, especially in the BRICS bloc (Brazil, Russia, India, China, South Africa), to explore gold-backed currencies and alternative settlement systems.

While a unified BRICS currency likely remains a long shot (due to conflicting interests), the trend is clear:

- Central banks are buying gold.

- Countries are increasingly settling more trade outside of the dollar.

- The world as whole is diversifying away from USD.

Since gold is priced in dollars, a weakening dollar naturally drives prices higher (assuming all other factors remain constant). But it goes deeper than that. The de-dollarization trend is also about trust. The world is hedging against U.S. fiscal irresponsibility, weaponized sanctions/tariffs, geopolitical tensions, and the long-term value of the greenback.

These factors appear to be bullish for gold in 2025 and beyond.

7. Historical Parallels and Market Manipulation Concerns

If history is any guide, the current environment is ripe for gold to continue its run.

Gold tends to outperform in periods marked by:

- Sovereign credit shocks (e.g., Fitch’s 2023 U.S. downgrade)

- Global recessions and monetary easing (2008, 2020)

- Rising global tensions and conflict (1970s, Gulf War, Ukraine)

Currently, we’re facing all three.

There’s also a growing conversation about gold price suppression in futures markets. While theories range from plausible to conspiratorial, they’re not entirely unfounded. U.S. regulators have fined major institutions (e.g., JPMorgan, Deutsche Bank) for manipulating metals benchmarks and spoofing trades in the past.

As trust in COMEX and LBMA systems fades, especially if delivery becomes constrained even further or audits uncover issues, gold could very well continue its run.

Conclusion: Is Gold a Good Investment Right Now?

Let’s recap the landscape:

- The U.S. just got hit with its third major credit rating downgrade.

- Central banks—especially in Asia—are buying gold at record levels.

- Physical delivery is surging, exposing the fragility of paper markets.

- The U.S. dollar is weakening amid rising de-dollarization efforts.

- Tariffs, wars, and fractured diplomacy are injecting geopolitical volatility.

- And recession risks still loom.

All of these considerations are positive indicators for continued increase in both demand and price for gold.

It doesn’t produce yield. It doesn’t pay dividends. But it also doesn’t default; and in 2025, that might be its most valuable feature.

If you’re wondering, “Is gold a good investment right now?” ask yourself:

- Do you trust the dollar?

- Do you trust government spending discipline?

- Do you trust the current state of the market and/or related volatility?

If the answer to any of those is “not fully,” then the case for gold becomes increasingly relevant.

In 2025, it’s no longer just an inflation hedge. It’s a hedge against instability, deception, and overconfidence in a system which is apparently being stretched to its limits.

Bearish Considerations:

Please note: This article presents a BULL case for gold in 2025 and beyond. However, it’s important to weigh several risks and limitations when investing in a physical commodity like gold:

- Gold generates no income. Unlike stocks or bonds, it pays no dividends or interest.

- Rising interest rates often reduce gold’s appeal.

- Gold prices are volatile and can fluctuate based on various sentiment and macroeconomic shifts.

- Opportunity costs of holding gold instead of historically higher-return asset classes such as equities or real estate.

- Gold lacks a value-creation engine. There’s no CEO or business model working to grow its value like with companies. Its price is driven purely by supply and demand.

- Physical gold can incur storage and insurance costs, while gold ETFs carry annual management fees.

- In the U.S., gold is taxed as a collectible which is currently subject to a higher capital gains tax rate of up to 28%.

Frequently Asked Questions (FAQ)

Will gold prices go up in 2025?

Most analysts believe so. JP Morgan expects it to surpass $4,000 by Q2 2026 due to central bank demand and macro instability. Central bank buying, U.S. credit downgrades, rising physical demand, and geopolitical instability are all pushing prices higher.

What caused gold to hit $3,400 in early 2025?

Gold spiked to over $3,400 per ounce in early 2025 following a series of events including President Trump’s new historically high tariffs (“Liberation Day”), U.S. credit concerns, central banks increasing their reserves, and a surge in physical delivery demand on COMEX. These events triggered a flight to safe-haven assets such as gold.

Is gold a good investment right now?

It depends on your individual situation and goals. It potentially could be a good addition to one’s portfolio as a hedge against inflation, volatility, and declining faith in fiat systems.

Why are central banks buying gold in 2025?

The exact reasons will be on a situational basis but it is likely many central banks are utilizing this as a hedge against U.S. dollar exposure and to increase politically neutral reserves during uncertain times.

Is the U.S. dollar losing dominance?

The US dollar is still the most dominant currency by far. That being said, the US dollar’s dominance it once had has slowly been deteriorating over the past few decades. Global reserve share is at a thirty-year low. De-dollarization has been and continues to be underway.

Could gold be manipulated or suppressed?

There’s growing concern that paper gold markets (e.g. COMEX) may not reflect true physical demand. Legal cases involving spoofing and price manipulation have targeted major institutions. Some investors are shifting to physical bullion due to issues with trust in these markets.

What are the biggest risks to gold prices in 2025?

Unexpected monetary tightening or a surprisingly strong economy could cap gains; however, given the current macroeconomic landscape, many see downside as limited relative to the upside.

Disclosure:

This article is for informational purposes only and does not constitute financial or investment advice. The views expressed are those of the contributor and are based on publicly available information and personal analysis.

The contributor holds positions in physical gold and gold-related securities, including gold mining companies, and may benefit from any price appreciation discussed herein. This potential conflict of interest is disclosed for transparency.

No representation is made as to the accuracy or completeness of the information provided. Readers are solely responsible for verifying any facts and should consult a licensed financial advisor before making investment decisions. Past performance is not indicative of future results.