How To Dispute Credit Reports

Featured Image Above from © danielfela @ stock.adobe.com

Why to Dispute Credit Reports:

Credit scores can affect everything from employment, loan eligibility, to the ability to rent an apartment. Be wary of scam artists promising the removal and/or assisting in the improvement of one’s credit score for an upfront fee. The process on how to dispute credit reports can be long and lengthy.There is no guarantee in removing a negative mark and the best practice companies will only accept payment after they have furnished the deliverable. Even the best practice companies charge clients a premium price to assist in the removal of negative marks on their client’s credit reports. Do It Yourself Credit Repair: Removing Negative Marks on Credit Report is the first of a series of articles on how to repair and ultimately improve your credit score without having to pay expensive prices and trusting a stranger with your most sensitive of information. This will serve as step-by-step guide on how to remove negative marks and dispute credit reports no matter what the Credit Reporting Agency (CRA) or Original Lender (OL) decide to throw at you.

Steps to Dispute Credit Reports:

Step #1: The first step in How to Dispute Credit Reports would be to request your annual credit report from all three agencies. Federal law requires Credit Reporting Agencies (CRA) such and Experian, TransUnion, and Equifax to provide a free credit report once every 12 months. These can be requested online at annualcreditreport.com or can be sent via mail with the downloaded form from each creditor’s website.

Step #2: Diligently review your credit report for any errors or discrepancies. Comb through each report several times looking at dates, addresses, lenders, names, etc.

Step #3: The third step in How to Dispute Credit Reports is to highlight any negative marks on your credit report. Approximately one out of every four credit reports include an error that negatively affects that person’s credit score. Some of the errors you should be looking for would include an incorrect lender, inaccurate dates, and never existing accounts. So long as one can take a justifiable position and argue his or her case, it is worth filing a dispute. Under the Fair Credit Reporting Act (FCRA), bankruptcies and tax liens have a statute of limitations of ten years; for most other negative claims which would appear on a credit report, statute of limitations is seven years from when the debt FIRST became delinquent. If a negative mark falls outside this window, federal law requires the CRA to remove such a claim. If the original lender’s debt was sold off to a collections agency, statute of limitations begins when the balance first became delinquent under the original lender.

Step #4: If all the negative marks found are accurate and one fails to be able to reach a justifiable position for dispute skip to Step #7. If a justifiable position can be made from an error or if one of the claims have already been paid in full, gather any evidence that supports such a claim and send a letter to the CRA with the support attached to the original credit report highlighting the areas of dispute. Request verification of debt including the first date of delinquency referencing the Fair Debt Collections Practices Act (FDCPA). This can be done for the same error multiple times with a difference basis for the dispute but it is recommended to give a month or two in between the disputes so it doesn’t appear frivolous. CRAs must respond within 30 days. Disputes can be filed online via each CRA’s online dispute form or can be sent via certified mail. Each delivery method has its perks. The online form is much quicker, cheaper, and convenient but there is no guarantee or evidence of receipt. Sending it via certified mail is slower but the sender can request a return receipt which later can be used as evidence for removal if the CRA has not followed up within 30 days.

Send this same letter and support to the creditor making the claim. Make sure the address used is the address of correspondence which can differ from than the address on the actual bill. If you do not hear back within a week or two you can try a new address such as the corporate address or simply just call in. I recommend calling corporate as many customer service agencies are outsourced and commonly do not have access and/or the ability to remove or provide such evidence. Do NOT send original copies of documents. Remember to be precise and professional in these writings.

Step #5: Under the FCRA 611 (a) (6) and (7), if the dispute comes back as accurate you have the right to request the method of verification which must be provided to the individual by the CRA within 15 days. You can either call or send a certified letter with a return receipt requesting verification. This request for the method of verification should include the name of creditor, person’s name they verified dispute with, sufficient documentation used to verify dispute, address of correspondence, and direct line telephone number of person the CRA reached out to. If the CRA cannot provide this (which in most cases they won’t be able to because their entire system is automated) ask for the contact’s direct phone number. Next you will reach out to the creditor from the information provided by the CRA and demand a copy of their records of verification of claim under The Fair and Accurate Credit Transactions Act (FACT Act). If they do not have records or say that the collection agency has the records, request the name of person to contact and their direct line. Attempt to get this in writing to include in your support for the CRA. Now call the CRA contact you spoke to prior and tell them that the original lender does not have any record of such a claim and you want to open a new dispute. If they refuse, ask to speak to management and inform them you know your rights and if they do not cooperate you will be forced to sue under FCRA 616 for willful noncompliance. If this does not work, then send a request letter for a new dispute along with intent to sue letter citing FCRA 616 via certified mail. This along with many of these letters can be printed online from an array of free sample templates.

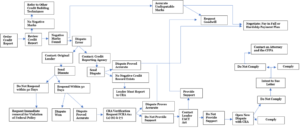

Below is a step-by-step chart to follow that summarizes the various scenarios one might face in getting a negative mark off one’s credit report:

Step-By-Step How to Get Negative Mark Off Credit Report Chart

Step #6: If at any point one of these parties is not cooperating or a severe problem arises, contact each party’s governing agency. Usually one must first attempt to dispute a claim prior to contacting these agencies. For the lenders, this would be either the State’s Attorney General or the Federal Trade Commission. For the CRAs this is the Consumer Financial Protection Bureau.

Step #7: If Steps 1-6 on How to Dispute Credit Reports fail or if the negative mark is accurate and one cannot think of a justifiable reason to dispute, the individual still has a few options to dispute credit reports:

Option 1: The individual can request a “goodwill adjustment”. This is a letter to the lender requesting a goodwill adjustment based on being an outstanding loyal customer which was put under duress due to a series of serious unfortunate life events which caused you to become delinquent. Explain to them exactly what they would have to do to remove the claim. This would include contacting the CRAs and requesting a complete removal. Many templates can be found online on this topic but here is an example of what one might include, “I have been a loyal customer for over 10 years and really appreciate your product/service. I am writing you because a few years back I was diagnosed with a medical condition which caused me to miss work for three months; in turn, this caused me to become delinquent on a couple of payments which sent my account into default. I understand this is wrong and it should have never happened. I completely own up to my mistakes but I write you today in hopes that you will understand, forgive, and ultimately remove these negative marks on my credit report. These negative marks are causing me undue hardship in providing for my family.” If possible include any relevant support for this hardship.

Option 2: The individual can simply negotiate with the lender. Call the lender that is reporting this negative claim and learn of your options. DO NOT, I REPEAT DO NOT settle with the lender for a reduced amount. The lender will likely report the account as “settled” rather than “paid” which by and of itself is a negative mark. The logic behind this reasoning is negative marks have less impact on a credit score the older they are and most marks are completely removed after seven years. If you reopen this account for a reduced amount the statute of limitations could potentially restart and it will become a more recent negative mark on your credit report. To insure this from happening one can request a pay for delete offer or a hardship payment plan. Many of these companies will have already written the debt off so if you are willing and able to pay it in full, they probably will be more than happy to remove the claim. Get the agreement in writing and request a copy of correspondence with CRAs after you have held up your side of the agreement.

How to Dispute Credit Reports Keys to Success:

Be Persistent: This is a rather lengthy process that more likely than not will throw you a couple curve balls. Make as many justifiable disputes as possible for each claim but space these disputes out so it does not seem to be frivolous.

Pick Up the Phone: Do not be afraid to pick up the phone and reach out to these agencies and lenders.

Be Professional: Nobody enjoys having to fix their credit score, but the more professional and polite you are the better chance somebody from the CRA or lender will be willing to help.

Do Not Provide Adverse Support: Do not provide support that would contradict your position for dispute. Many people believe that the more information they send the better. This is true so long as the support you send backs your position.

Be Patient: This process takes time. Do not expect for this to get done within a day or even a week for that matter. Start the process then follow the provided steps and graph to help guide you through it.

Get Everything in Writing: Attempt to get as much information as possible in writing.

Utilize Online Resources: One can find a vast array of drafted templates for each of the letters cited in the above article online.

Here are credit cards that will save you the most amount of money.